Cards

MPU Credit Card

The KBZ MPU Credit Card is the most sophisticated and simple to use anywhere in the country that is connected to MPU. Since MPU Credit Card allows customers to effortlessly make transaction, it is very practical for online/offline payment, shopping and dining at the restaurants.

Benefits

- Able to use in any local stores which accept MPU

- Able to use at any POS machine and E-commerce connected to MPU

- Lower interest rates and fees

- Free of charge for joining fees and annual fees

- Able to earn interest on the deposited amount

- Specifically designed for domestic usage

- Cashless payment

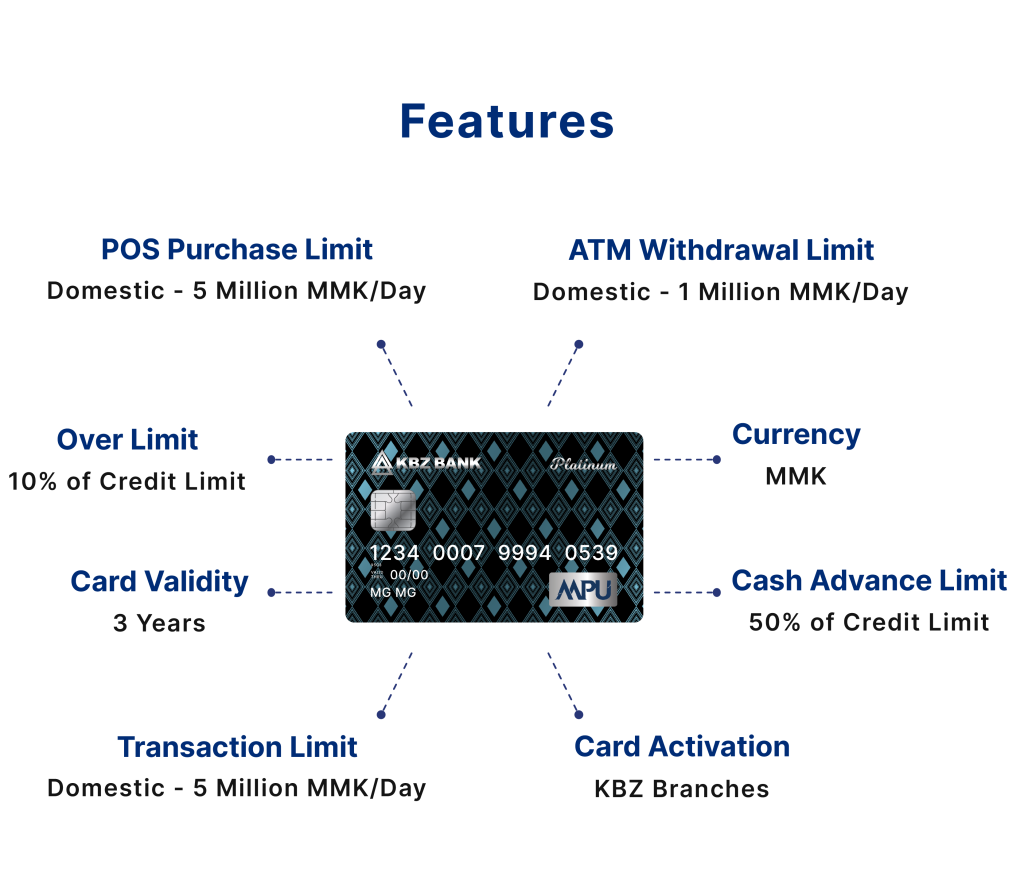

Card Validity

3 years

Currency

MMK

Over Limit

10% of Credit Limit

Cash Advance Limit

50% of Credit Limit

Card Activation

KBZ Branches

POS Purchase Limit

Domestic – 5 Million MMK/Day

ATM Withdrawal Limit

Domestic – 1 Million MMK/Day

Transaction Limit

Domestic – 5 Million MMK/Day

Detailed Terms and Conditions are listed in the PDF, click on Download to view them. Download

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 30,000 MMK |

| • Renewal Fee (Supple) | – 15,000 MMK |

| • Annual Fee (Principle) | – 80,000 MMK |

| • Annual fee (Supple) | – 40,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fees (KBZ ATM) | –5%(Min -5,000 MMK) |

| • Cash Advance Fees (Other MPU’s ATM) | -5%(Min -5,000 MMK)+Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 3% (Min – 10,000 MMK) |

| • Interest Rate (Annual) | – 18% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 10,000 MMK |

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 20,000 MMK |

| • Renewal Fee (Supple) | – 10,000 MMK |

| • Annual Fee (Principle) | – 40,000 MMK |

| • Annual fee (Supple) | – 20,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fees (KBZ ATM) | – 5%(Min -5,000 MMK) |

| • Cash Advance Fees (Other MPU’s ATM) | – 5%(Min -5,000 MMK)+Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 3% (Min – 10,000 MMK) |

| • Interest Rate (Annual) | – 18% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 7,000 MMK |

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 15,000 MMK |

| • Renewal Fee (Supple) | – 7,500 MMK |

| • Annual Fee (Principle) | – 20,000 MMK |

| • Annual fee (Supple) | – 10,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fees (KBZ ATM) | – 5%(Min -5,000 MMK) |

| • Cash Advance Fees (Other MPU’s ATM) | – 5%(Min -5,000 MMK)+Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 3% (Min – 10,000 MMK) |

| • Interest Rate (Annual) | – 18% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 5,000 MMK |

Detailed Terms and Conditions are listed in the PDF, click on Download to view them. Download

| Minimum Requirement | 100% of Deposit Amount |

| Credit Limit | Classic – MMK 2 Lakhs to 50 Lakhs Gold – MMK 10 Lakhs to 50 Lakhs Platinum – MMK 10 Lakhs to Maximum Credit Limit 300 Lakhs |

| Period of Facility | 3 Years |

| Billing Cycle | On 15th of each month |

| No Interest Period (applicable only for full payment | 45 Days (Starting from beginning of billing date and end on the payment due date) |

| Interest Rate | 18% |

| Repayment Amount | – Full Payment – Partial Payment – Minimum Payment – 10% of Total Outstanding |

| Repayment Method | – Auto debit from customer current Individual or Join Account (Personal) a/c – OTC at branch – Mobile Banking (QuickPay) – KBZPay (QuickPay) |

| Supplementary Card | Maximum 4 Supplementary Card |

| Required Document | – Application Form – NRC (Front/Back) |

| Processing Time | – 3 Working Days (Yangon Region) – 7 Working Days (Other Region) |

Detailed Terms and Conditions are listed in the PDF, click on Download to view them. Download

Guide to using MPU Credit Card

Since your credit card is only in inactive mode, it is necessary to activate the card at the KBZ bank branch when you pick up the card.

To do the Card Activation

- There is a signature area on the back of the card, you must sign in that space.

- The activation form must be signed.

Steps to change ATM PIN

- Insert your credit card into the nearest KBZ ATM machine.

- After inserting the card at the KBZ ATM, KBZ Bank will send a One-time Password (OTP) Message to your mobile phone that you provided when you applied for the card.

- When you receive the OTP (6) numbers, enter them in the ATM machine.

- To change the new PIN, enter the new ATM PIN (6) numbers that you want to keep two times.

Detailed Terms and Conditions are listed in the PDF, click on Download to view them. Download

MPU Credit Card

(Platinum)

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 30,000 MMK |

| • Renewal Fee (Supple) | – 15,000 MMK |

| • Annual Fee (Principle) | – 80,000 MMK |

| • Annual fee (Supple) | – 40,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fee (KBZ ATM) | – 3% (Min. 5,000 MMK) |

| • Cash Advance Fee (MPU ATM) | – 3% (Min. 5,000 MMK) + Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 2.5% (Min. 10,000 MMK) |

| • Interest (Per Annum) | – 20% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 10,000 MMK |

MPU Credit Card

(Gold)

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 20,000 MMK |

| • Renewal Fee (Supple) | – 10,000 MMK |

| • Annual Fee (Principle) | – 40,000 MMK |

| • Annual fee (Supple) | – 20,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fee (KBZ ATM) | – 3% (Min. 5,000 MMK) |

| • Cash Advance Fee (MPU ATM) | – 3% (Min. 5,000 MMK) + Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 2.5% (Min. 10,000 MMK) |

| • Interest (Per Annum) | – 20% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 7,000 MMK |

MPU Credit Card

(Classic)

| • Joining Fee (Principle) | – Free |

| • Joining Fee (Supple) | – Free |

| • Renewal Fee (Principle) | – 15,000 MMK |

| • Renewal Fee (Supple) | – 7,500 MMK |

| • Annual Fee (Principle) | – 20,000 MMK |

| • Annual fee (Supple) | – 10,000 MMK |

| • Card Fees | – Free |

| • PIN Reissuing Fee | – Free |

| • Cash Advance Fee (KBZ ATM) | – 3% (Min. 5,000 MMK) |

| • Cash Advance Fee (MPU ATM) | – 3% (Min. 5,000 MMK) + Other Bank Charges |

| • Balance Inquires Fees (KBZ ATM) | – Free |

| • Balance Inquires Fees (MPU ATM) | – Free |

| • Card Replacement Fees | – 10,000 MMK |

| • Late Fees (Per Month) | – 2.5% (Min. 10,000 MMK) |

| • Interest (Per Annum) | – 20% |

| • Limit Charge Fee | – 10,000 MMK |

| • Over Limit Fee (Per Month) | – 5,000 MMK |

Minimum Requirement

100% of Deposit Amount

Credit Limit

Classic – MMK 2 Lakhs to 50 Lakhs

Gold – MMK 10 Lakhs to 50 Lakhs

Silver – MMK 10 Lakhs to Maximum Credit Limit 300 Lakhs

Period of Facility

3 Years

Billing Cycle

On 15th of each month

No Interest Period (applicable only for full payment)

45 Days (Starting from beginning of billing date

and end on the payment due date)

Interest Rate

18 %

Repayment Amount

• Full Payment

• Partial Payment

• Minimum Payment – 10% of Total Outstanding

Repayment Method

• Auto debit from customer current Individual or Joint Account (Personal) a/c

• OTC at branch

• Mobile Banking (QuickPay)

• KBZPay (QuickPay)

Supplementary Card

• Maximum 4 Supplementary Card

Required Document

• Application Form

• NRC (Front/Back)

Processing Time

• 3 Working Days (Yangon Region)

• 7 Working Days (Other Region)

Guide to using MPU Credit Card

Since your credit card is only in inactive mode, it is necessary to activate the card at the KBZ bank branch when you pick up the card.

To do the Card Activation

- There is a signature area on the back of the card, you must sign in that space.

- The activation form must be signed.

Steps to change ATM PIN

- Insert your credit card into the nearest KBZ ATM machine.

- After inserting the card at the KBZ ATM, KBZ Bank will send a One-time Password (OTP) Message to your mobile phone that you provided when you applied for the card.

- When you receive the OTP (6) numbers, enter them in the ATM machine.

- To change the new PIN, enter the new ATM PIN (6) numbers that you want to keep two times.

Detailed Terms and Conditions are listed in the PDF, click on Download to view them. Download

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES DETAILS | VALID UNTIL |

|---|---|---|---|---|

| Hla Spa | Yangon | Exclusive Discount 15% on all services (All Service of Hla Spa Lifestyle- 15% (Minimun price is $25++.) | 1 Feb 2024 to 1 Feb 2025 |

| Shwe Mingalar Spa | Yangon | Exclusive Discount 10% on all services | 16 Mar 2025 to 15 Mar 2026 |

| Eliza | Yangon | -Exclusive 10,000MMK off on Complete Facial Treatment -Exclusive 5 % Discount on Skincare" | 16 Mar 2025 to 15 Mar 2026 |

| Inya Day Spa | Yangon | 20% discount for all service | 16 Mar 2025 to 15 Mar 2026 |

| Jasmine Dental Center | Yangon | 5% Discount for all treatment | 1 Feb 2024 to 1 Feb 2025 |

| Barberlogy Barbershop | Yangon | 10% Discount for All Types of Services | 1 Feb 2024 to 1 Feb 2025 |

| 5BB Broadband Fiber Internet Service | Yangon | 5% Discount on Bill (additional add-in seasonal promotion) | 1 Feb 2024 to 1 Feb 2025 |

| 77 Baby Store | Yangon | Exclusive Discount 5% on all products | 16 Mar 2025 to 15 Mar 2026 |

| PRO 1 Global | Yangon Mandalay | Spending with KBZ MPU Platinum and Gold Credit Cards- Get PRO 1 Global Member card | 1 Feb 2024 to 1 Feb 2025 |

| Imperial Clinic | Yangon | Up to 50% Discount (except injection) Include Laser, Facial, RF Microneedling, Hifu, Cool Shaping Treatment | 1 Feb 2024 to 1 Feb 2025 |

| The Mystique | Yangon | - Exclusive 10% discount on your bill - Seasonal promotions cannot be combined - Only one promotion can be used at a time | 25 Apr 2024 to 24 Apr 2025 |

| Derma Pro Skin & Aesthetic Clinic | Yangon | - Exclusive 10% discount on your bill - Seasonal promotions cannot be combined - Only one promotion can be used at a time | 25 Apr 2024 to 24 Apr 2025 |

| Oasis Bleu Spa | Yangon | - Exclusive 10% discount on your bill - Seasonal promotions cannot be combined - Only one promotion can be used at a time | 25 Apr 2024 to 24 Apr 2025 |

| MHR Management Institute | Yangon | Exclusive 7% discount and additional promotion | 2 Jul 2024 to 1 Jul 2025 |

| Soul Sanctuary Spa | Yangon | Exclusive 5% discount on all aesthetic body massages and spa treatments (not combinable with seasonal promotions) | 12 Jun 2024 to 11 Jun 2025 |

| BOB Entertainment | Mandalay | 20% Discount on room rate | 09 Jul 2024 to 09 Jul 2025 |

| VX Supplements | Yangon | Exclusive 10% discount on total bill | 01 Sep 2024 to 31 Aug 2025 |

| Fit Way Gym | Yangon | 10% Discount for 1 Month Membership 15% Discount for 3 Month Membership 20% Discount for 6 Month Membership 30% Discount for 1 Year Membership | 01 Sep 2024 to 31 Aug 2025 |

| MK Watch Myanmar | Yangon | Exclusive 5% discount on total bill | 01 Sep 2024 to 31 Aug 2025 |

| Fit Republic | Mandalay | 5% Discount for 1 Month Membership 7% Discount for 3 Month Membership 10% Discount for 6 Month Membership 15% Discount +1month free for 1 Year Membership | 03 Sep 2024 to 03 Sep 2025 |

| Ananda Special Clinic | Mandalay | 5 % Discount on medical package (Silver,Gold,Platinum) | 06 Sep 2024 to 06 Sep 2025 |

| Mandalar Hospital | Mandalay | 1. Outpatient Service Fees - 20% 2. Inpatient Service Room Fees - 10% 3. Laboratory & Imaging Services - 5% Dental Center Services 1. Dental All Procedure Services - 10% 2. Dental Imaging Services - 5% | 04 Sep 2024 to 04 Sep 2025 |

| Myat Taw Win Hospital | Taunggyi | 1. Outpatient Service Fees - 20% 2. Inpatient Service Room Fees - 10% 3. Laboratory & Imaging Services - 5% | 04 Sep 2024 to 04 Sep 2025 |

| Cherry Land | Pyin Oo Lwin | 1. Hospital Services Fees - 20% 2. Room Fees - 10% 3. lnvestigation Fees - 5% 4. Scopy - 5% 5. Onco -5% 6. HD -5% 7. MCU -5% | 05 Sep 2024 to 05 Sep 2025 |

| M2K | Mandalay | 5 % Discount on 1 month to 12 months membership | 11 Sep 2024 to 11 Sep 2025 |

| OMEGA Spa & Salon | Yangon | Exclusive 15% discount on bill, (except traditional massage ) Seasonal promotion are not allowed to be combined. | 22 Apr 2024 to 21 Apr 2025 |

| Novo Cosmetics Myanmar | Yangon | Exclusive 10 % on Bill for all NOVO products (Minimum Spending 30,000 Kyats) | 10 Oct 2024 to 09 Oct 2025 |

| HEXA Aesthetic & Wellness | Mandalay | Any items minimum purchase 300,000 Kyats and above will receive one gift voucher of ‘30,000’ Kyats. Any items purchase above 800,000 Kyats will have a chance to play spin wheel. | 03 Oct 2024 to 03 Oct 2025 |

| Htet Nay Lin Hospital | Mandalay | Outpatient service - 10% Discount Inpatient service - 10% Discount Laboratory service - 5% Discount Imaging service - 10% Discount Endoscopy service - 10% Discount Surgical procedure service - 5% Discount | 15 Oct 2024 to 15 Oct 2025 |

| Gentleman Liquor Shop | Yangon | Get 10,000 MMK Coupon if spend 100,000 MMK or more in One Go! | 16 Dec 2024 to 15 Dec 2025 |

| Country Liquor Shop | Yangon | Get 10,000 MMK Coupon if spend 100,000 MMK or more in One Go! | 16 Dec 2024 to 15 Dec 2025 |

| York Liquor | Yangon | Get 10,000 MMK Coupon if spend 100,000 MMK or more in One Go! | 16 Dec 2024 to 15 Dec 2025 |

| Jade Angel Cosmetics | Mandalay | 5% discount on bill | 06 Nov 2024 to 06 Nov 2025 |

| MAUNG AYE AND SONS OPTICAL | Yangon | - 15 % discount for all KBZ Platinum Credit Cards - 10 % discount for all KBZ Classic and Gold Credit Cards | 01 Jan 2025 to 31 Dec 2025 |

| Aye Optical | Yangon | - 15 % discount for all KBZ Platinum Credit Cards - 10 % discount for all KBZ Classic and Gold Credit Cards | 01 Jan 2025 to 31 Dec 2025 |

| AMAC | Yangon | Purchasing 1,000,000 will get 6% Discount | 10 Dec 2024 to 10 Dec 2025 |

| မဟာနီလာ | Mandalay | Cashback 50000 MMK on motor cycle&Three wheels Cycle | 04 Dec 2024 to 04 Dec 2025 |

| Super Star Wedding Dress | Yangon | Purchasing over 100,000 will get 5% Discount Purchasing over 200,000 will get 10% Discount | 11 Dec 2024 to 11 Dec 2025 |

| Hair Dr. Professional | Yangon | 5 % discount for All KBZ Credit Cards on All Services | 16 Jan 2025 to 15 Jan 2026 |

| BBN NUTRITION | Yangon | - Spend Up to 500,000 MMK and Get a Keychain or Ball Pen with Member Points - Spend Over 500,000 MMK and Enjoy a Shaker Bottle or Glass or Gym Vest and Plus Extra Member Points | 16 Feb 2025 to 15 Feb 2026 |

| HARUNA Health & Wellness Center | Yangon | Exclusive 25 % discount for all service | 16 Feb 2025 to 15 Feb 2026 |

| The Warehouse | Yangon | - Exclusive 10% discount on bill - Minimum spending 100,000 MMK | 16 Feb 2025 to 15 Feb 2026 |

| J. Me | Mandalay | - 10% Discount Above 100,000 (Floral Only) - 5%Discount Above 500,000 (Events Only) | 03 Jan 2025 to 03 Jan 2026 |

| 35 Pro | Mandalay | Minimum purchase 100,000 MMK and above will receive 5% Discount on bill | 10 Jan 2025 to 10 Jan 2026 |

| Beauty By Grace | Mandalay | 10% Discount On All Services | 15 Jan 2025 to 15 Jan 2026 |

| Xplode Gym | Yangon | 3% Discount for 1 Month Membership 7% Discount for 3 Month Membership 10% Discount for 6 Month Membership 15% Discount for 1 Year Membership | 16 March 2025 to 15 March 2026 |

| 808 Beauty Center | Yangon | Buying Item ( Hair Material only ) - 5 % Discount Shampoo (Service) - 10 % Discount Colour,Rebonding, Digital Perm,Hair Cut - 15 % Discount (Eligible for Yankin Branch, Kyaukkone Branch & Lanmadaw Branch ) | 16 February 2025 to 15 February 2026 |

| One Drop | Mandalay | Exclusive 5% Discount on Bill (Minimum Spending200,000 MMK) | 01 February 2025 to 01 February 2026 |

| GOLDEN PARK Hotel & Spaland | Yangon | 10 % discount on Bill for All KBZ Credit Card | 16 March to 15 March 2026 |

| Eye Care Optical Showroom | Yangon | Exclusive 10 % discount on Bill (additional add-in seasonal promotion) | 16th May 2025 to 15th May 2026 |

| NADIA Beauty & Spa | Yangon | Exclusive 15% discount on bill. | 16th May 2025 to 15th May 2026 |

| D-Molar Dental Specialist Clinic | Yangon | Exclusive 10 % Discount For Dental Cleaning Treatment, Dental Filling Treatment & Toothache Treatment. | 16th June 2025 to 15th June 2026 |

| Taw Win Thiri Luggage Store | Yangon | Exclusive 5 % Discount on Bill & Purchasing 1,000,000 MMK will get 100,000 MMK Cash Back! | 16th June 2025 to 15th June 2026 |

| Li Li Wellness & Beauty Center | Yangon | Exclusive 10% Discount for All Services. | 16th June 2025 to 15th June 2026 |

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES DETAILS | VALID UNTIL |

|---|---|---|---|---|

| Sense Clothing | Yangon | Exclusive 10% discount on the bill | 1 Feb 2024 to 1 Feb 2025 |

| V Smart Clothing | Yangon | Exclusive 10% discount on the bill | 29 May 2025 to 28 May 2026 |

| Summer Shoes House Shop 1: 80 St, between 36th and 37th Shop 2: 73 St, between 36th and 37th | Mandalay | 5% discount on the bill (Except for Pedro, Walkes, Scholl, Adidas, Skechers, and Crocs) | 28 Jun 2024 to 28 Jun 2025 |

| Royal ဒေဝီ | Mandalay | 10% discount on the bill | 07 Aug 2024 to 07 Aug 2025 |

| Iconic Fashion | Mandalay | Exclusive discount 10% on selected brands (Adidas, Nike, Polo, G2000, Puma, H&M, Uniqlo & Other BKK brands) | 07 Aug 2024 to 07 Aug 2025 | |

| Alpha Collection | Yangon | Exclusive 10% discount on your bill with a minimum spend of 100,000 Kyats | 01 Sep 2024 to 31 Aug 2025 |

| Baby Born Shop (Kids Clothings Accessories) | Yangon | Exclusive 5% discount on all items with a minimun spend of 80,000 Kyats | 01 Sep 2024 to 31 Aug 2025 |

| Dream Dresser & Kee | Mandalay | - 5% Discount on bill ( Above 50,000 Kyats) - 7% Discount on bill (Above 100,000 Kyats) | 11 Sep 2024 to 11 Sep 2025 |

| Almond Clothing Store | Mandalay | Exclusive 5% Discount on Bill (Minimum Spending 50,000 MMK) | 01 February 2025 to 01 February 2026 |

| FRENZY Exclusive Sneakers | Yangon | All Sneakers - 5 % Discount Clothings - 7 % Discount Socks & Accessories - 10 % Discount | 16 March 2025 to 15 March 2026 |

| AK 1 Fashion | Mandalay | 5% Discount On Bill | 13 February 2025 to 12 February 2026 |

| Mr.Confident Shoes | Yangon | Enjoy get a sock by purchasing any sneakers and shoes! | 16 Apr 2025 To 15 Apr2026 |

| စကားဝါ ရိုးရာချည်ထည် | Yangon | Exclusive 30% Discount on selected Items. | 16th May 2025 to 15th May 2026 |

| Boss Nation | Yangon | Exclusive 2 % discount on Bill (additional add-in Membership promotion) | 16th June 2025 to 15th June 2026 |

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES OFFER FOR MPU CREDIT CARD | VALID UNTIL |

|---|---|---|---|---|

| Jasmine Palace Hotel | Yangon | - 10% Discount for outlets (Spa, bakery, buffet) - 10% Discount on walk-in room rate | 1 Feb 2024 to 1 Feb 2025 |

| Hotel Yadanarbon Mandalay | Mandalay | (2nd Feb - 30th Sep 2025 (Except Thingyan Period 12-21 Apr) Room : 5% OFF on Walk in rate F&B : 10% OFF @ Sky Bar Restaurant/ Rooftop bar Laundry : 10% OFF (1st Oct 2025 - 31st Jan 2026) Room : 5% OFF on Walk in rate F&B : 5% OFF @ Sky Bar Restaurant/ Rooftop bar Laundry : 10% OFF | 2 Feb 2025 to 1 Feb 2026 |

| UCT Taunggyi Hotel | Taunggyi | -Enter 500,000/- (5% discount all services on bill) -Above 500,000/-(up to 10% discount all services on bill) | 11 Feb 2025 to 10 Feb 2026 |

| Super Hotel Thilawa | Yangon | Exclusive 10% Discount | 9 May 2024 to 8 May 2025 |

| Bay of Bengal Hotel Resort | Ngwe Saung | competitive rates with 5% discount on our Public Rates ( means seasonal promotion or flash sales rates + 5% discount ) for Myanmar Citizens & Expatriates. | 5th June 2025 to 5 June 2026 |

| New Chaung Tha Hotel | Chaung Tha | 10% discount on the overall room rate (excluding Thingyan, Christmas, and New Year holidays) | 31 Jul 2024 to 30 Jul 2025 |

| Aureum Palace Hotel & Resort | Bagan, Inle, Ngwe Saung, Naypyitaw | 10% discount on accommodation, food, beverages, and spa services (available only for MPU Gold and Platinum credit cards) | 1 Aug 2024 to 31 Jul 2025 |

| Popa Mountain Resort | Popa | 10% discount on accommodation, food, beverages, and spa services (available only with MPU Gold and Platinum credit cards) | 1 Aug 2024 to 31 Jul 2025 |

| Pathein Hotel | Pathein | 10% discount on accommodation, food, beverages, and spa services (available only with MPU Gold and Platinum credit cards) | 1 Aug 2024 to 31 Jul 2025 |

| Espace by Aureum | Yangon | 10% discount on accommodation, food, beverages, and spa services (available only with MPU Gold and Platinum credit cards) | 1 Aug 2024 to 31 Jul 2025 |

| Olympic Hotel | Yangon | 10% Discount on accommodation | 1 Sep 2024 to 31 Aug 2025 |

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES DETAILS | VALID UNTIL |

|---|---|---|---|---|

| Super Mobile | Mandalay | Exclusive Discount 15% on Accessories (expect Apple & Samsung original product) | 11 Feb 2025 to 10 Feb 2026 |

| Power Mobile | Mandalay | Exclusive Discount 20% on Accessories (except Apple Products & Power Banks, maximum 100,000 MMK) | 11 Feb 2025 to 10 Feb 2026 |

| Home Aid | Mandalay | 3% Discount on all items(Limit Amount Miximum 500,000/-) | 11 Feb 2025 to 10 Feb 2026 |

| Smart Computer Technology | Yangon | For Laptop Up to 30,000 to 150,000 MMK Discount (Depend on Models and Brand) For Gaming Laptop 100,000 MMK Discount (Gaming Laptop under 40 Lakhs) 150,000 MMK Discount (Gaming Laptop over 40 Lakhs) For Office Laptop 30,000 MMK Discount (core i3 Laptop) 50,000 MMK Discount (core i5 Laptop) 70,000 MMK Discount (core i7 Laptop) For Desktop Up to 30,000 to 70,000 MMK Discount (Depend on Model and Brand) 30,000 MMK Discount (core i3 Desktop) 50,000 MMK Discount (core i5 Desktop) 70,000 MMK Discount (core i7/i9 Desktop) | 16 Mar 2025 to 15 Mar 2026 |

| Phone King Service Center | Yangon | Exclusive Discount (Apple devices only) - Battery replacement: 5% off - Motherboard repair: 10% off - Glass replacement: 10% off - Back glass replacement: 10% off - LCD replacement: 5% off | 1 Jul 2024 to 30 Jun 2025 |

| T9 Mobile | Mandalay | - 5,000 Ks Cashback for spending up to 300,000 Ks - 10,000 Ks Cashback for 300,000 Ks to 600,000 Ks spend - 20,000 Ks Cashback for 600,000 Ks to 1,000,000 Ks spend - 30,000 Ks Cashback for over 1,000,000 Ks spend | 17 Jul 2024 to 17 Jul 2025 |

| D Dream Mobile | Mandalay | - Spend 500,000 Ks will get 20,000 Ks Cashback (Not Included Apple , Xiaomi (China) , Redmi (China) ) - Spend between 500,000 Ks and 1,000,000 Ks will get 30,000 Ks Cashback (Not Included Apple , Xiaomi (China) , Redmi (China) - Spend over 1,000,000 Ks will get 50,000 Ks Cashback (Not Included Apple , Xiaomi (China) , Redmi (China) ) - 5% Discount On Accessories (Not Included Apple Products) | 27 Nov 2024 to 27 Nov 2025 |

| Pro 9 Mobile | Mandalay | Spend over 500,000 Ks (Andriod & iOS ) - 20,000 Ks Cash Back Spend over 1,000,000 Ks (Andriod & iOS ) - 40,000 Ks Cash Back Spend over 2,000,000 Ks (Andriod & iOS ) - 60,000 Ks Cash Back | 20 Nov 2024 to 20 Nov 2025 |

| Speed | Mandalay | Accessories -10 % Discount (GADGET MAX,REMAX) Below 300,000 - 5000 Cash Back (VIVO,OPPO,SAMSUNG,INFINIX,TECNO,NUVIA,HUAWEI) 500,000 to 600,000 - 10000 Cash Back (VIVO,OPPO,SAMSUNG,INFINIX,TECNO,NUVIA,HUAWEI) 600,000 to 1,000,000 - 20000 Cash Back(VIVO,OPPO,SAMSUNG,INFINIX,TECNO,NUVIA,HUAWEI) Above 1,000,000 - 30000 Cash Back(VIVO,OPPO,SAMSUNG,INFINIX,TECNO,NUVIA,HUAWEI) | 10 Dec 2024 to 10 Dec 2025 |

| Splendid | Yangon | For Laptop Up to 30,000 to 150,000 MMK Discount (Depend on Models and Brand) For Gaming Laptop 100,000 MMK Discount (Gaming Laptop under 40 Lakhs) 150,000 MMK Discount (Gaming Laptop over 40 Lakhs) For Office Laptop 30,000 MMK Discount (core i3 Laptop) 50,000 MMK Discount (core i5 Laptop) 70,000 MMK Discount (core i7 Laptop) For Desktop Up to 30,000 to 70,000 MMK Discount (Depend on Model and Brand) 30,000 MMK Discount (core i3 Desktop) 50,000 MMK Discount (core i5 Desktop) 70,000 MMK Discount (core i7/i9 Desktop) | 16 Mar 2025 to 15 Mar 2026 |

| All Fine Mobile | Mandalay | 3% Discount on bill Mobile & All Accessories | 07 Mar 2025 To 06 Mar 2026 |

| I DEVICES MOBILE | Mandalay | Exclusive Discount 10% on Accessories | 11 March 2025 To 10 March 2026 |

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES DETAILS | VALID UNTIL |

|---|---|---|---|---|

| Splendid | Yangon | Laptop Discount - Up to a discount of 30,000 to 150,000 MMK (selected items) Gaming Laptop Discount - 100,000 MMK discount (under 40 Lakhs) - 150,000 MMK discount (over 40 Lakhs) Office Laptop Discount - 30,000 MMK discount (core i3 Laptop) - 50,000 MMK discount (core i5 Laptop) - 70,000 MMK discount (core i7 Laptop) Desktop Discount - Up to a discount of 30,000 to 70,000 MMK (selected items) - 30,000 MMK discount (core i3 Desktop) - 50,000 MMK discount (core i5 Desktop) - 70,000 MMK discount (core i7/i9 Desktop) Accessories Discount - Up to 15% discount (selected items) | 1 Feb 2024 to 1 Feb 2025 |

| LOGO | PARTICIPATING MERCHANTS | CITY | PRIVILEGES DETAILS | VALID TILL |

|---|---|---|---|---|

| Breeze Restaurant and lounge | Yangon | Exclusive 10% discount on foods | 1 Feb 2024 to 1 Feb 2025 |

| The SAKE BROS | Yangon | 5% discount for all items | 1 Feb 2024 to 1 Feb 2025 |

| Maha Chai Thai Restaurant | Mandalay | Exclusive Discount 10% on bill | 11 Feb 2025 to 10 Feb 2026 |

| Koffee Korner Cafe & Restaurant | Mandalay | Exclusive Discount 10% on bill | 11 Feb 2025 to 10 Feb 2026 |

| Noodle Bowl Restaurant & Lounge | Yangon | Get 10 % discount on all menu | 16 Mar 2025 to 15 Mar 2026 |

| Koffee Korner Cafe & Restaurant | Mandalay | Exclusive Discount 10% on bill | 11 Feb 2025 to 10 Feb 2026 |

| Yoeyar Sushi | Mandalay | 5% discount for bills above 8000 Ks | 30 Mar 2024 to 30 Mar 2025 |

| Byblos Pub & Grill | Yangon | Exclusive 5% discount on the bill | 1 Feb 2024 to 1 Feb 2025 |

| Bella Ciao | Yangon | Exclusive 10% discount on the bill | 1 Feb 2024 to 1 Feb 2025 |

| Hot Pot Diary | Yangon | -Exclusive Discount 5% off ( + Seasional promotion) | 16 Mar 2025 to 15 Mar 2026 |

| Steak Village | Yangon | Exclusive 15% discount on bill | 4 Apr 2024 to 4 Apr 2025 |

| Shwe Oak Tea House | Yangon | Exclusive 15% discount on your bill with a minimum spending of 7,000 MMK | 13 May 2024 to 13 May 2025 |

| The Tea | Mandalay | Exclusive 10% discount on bill | 24 Apr 2024 to 24 Apr 2025 |

| (Seoul City) 7- Level Korean Spicy Noddle | Yangon | Exclusive 10% discount on your bill with a minimum spending of 30,000 MMK | 11 Apr 2024 to 10 Apr 2025 |

| Bamboo Korea BBQ | Yangon | Exclusive 5% discount on bill (Seasonal promotions are not allowed to be combined) | 7 Jun 2024 to 6 Jun 2025 |

| TEADOT Shop 1: 73 St, between 32nd St Shop 2: Mingalar Mandalay | Mandalay | Exclusive 5% discount on bill | 24 Jun 2024 to 24 Jun 2025 |

| Imperial Restaurant | Mandalay | 5% discount on bill | 10 Jul 2024 to 10 Jul 2025 |

| Ocha Bubble Tea | Yangon | Exclusive 10% discount on bill | 22 Jul 2024 to 21 Jul 2025 |

| Mango Mania | Yangon | Exclusive 10% discount on bill | 22 Jul 2024 to 21 Jul 2025 |

| Mook Mookata | Yangon | Exclusive 10% discount on bill | 22 Jul 2024 to 21 Jul 2025 |

| KKS Thai Food & BBQ (8 Mile & Shwe Taung Kyar Branch) | Yangon | 5% discount on your bill with a minimum spend of 50,000 Kyats | 24 Jul 2024 to 23 Jul 2025 |

| NTH Degree | Yangon | 10% discount on bill (available only with MPU Gold and Platinum credit cards) | 1 Aug 2024 to 31 Jul 2025 |

| The Corriander Leaf: Indian Family Dining | Yangon | 15% discount on bill | 19 Aug 2024 to 18 Aug 2025 |

| Delhi Deli Contemporary Cafe | Yangon | 15% discount on bill | 19 Aug 2024 to 18 Aug 2025 |

| Wisteria | Mandalay | 10% discount on bill with a minimum spend of 100,000 Kyats | 15 Aug 2024 to 15 Aug 2025 |

| Sichuan House | Yangon | Exclusive 5 % Discount on bill with a minimun spend of 200,000 Kyats (Eligible For Gold Card And Platinum Card Only) | 19 Sep 2024 to 18 Sep 2025 |

| LUSH COFFEE | Mandalay | 5% Discount on bill ( Above 50,000 Kyats) 10% Discount on bill (Above 100,000 Kyats) | 09 Oct 2024 to 09 Oct 2025 |

| BOBA ICON | Mandalay | 5% Discount on bill | 23 Oct 2024 to 23 Oct 2025 | |

| K-Bibimbap | Yangon | Exclusive 15 % discount (Food Only) for all KBZ Credit Card (Eligible Minimun Spending 50,000 MMK for Dagon Center Branch, Insein-Bata Branch, Junction Square Branch) | 16 Dec 2024 to 15 Dec 2025 |

| Oriental House | Yangon | Exclusive 5 % discount for All KBZ Credit Card on Dinner only (Not included event dinner, Myoma Kyaung Street Branch Only) | 16 Dec 2024 to 15 Dec 2025 |

| Oriental House | Mandalay | 5 % Discount for All KBZ Credit Card On Lunch and Dinner (Not Included Dim Sum) | 13 Nov 2024 to 13 Nov 2025 |

| SHWE SA BWE RESTAURANT | Yangon | Get 5% Off for orders under 200,000 MMK, 10% Off for more orders | 16 Dec 2024 to 15 Dec 2025 |

| Jin Din Fung Chinese Cuisine | Yangon | Enjoy a 5% discount on all ala carte menu items Get complimentary VIP Room for 100,000 MMK or more usage | 16 Dec 2024 to 15 Dec 2025 |

| Hola Bakery | Mandalay | 10% discount on drink menu | 26 Nov 2024 to 26 Nov 2025 |

| Mandalay BBQ | Mandalay | 10 % discount for All KBZ Credit Cards(Food Only) | 01 Jan 2025 to 31 Dec 2025 |

| KO KO FU RESTAURANT | Yangon | - Exclusive 5 % Discount for all Menu ( YGN ) Outlets only - Minimun Spending 50,000 MMK | 01 Jan 2025 to 31 Dec 2025 |

| Cherry Restaurant | Mandalay | 10% Discount on bill (not include Drink Menu) | 06 Dec 2024 to 06 Dec 2025 |

| Casa Cafe | Mandalay | Purchasing 50,000 will get Red Valvet Cookies or Chocolate Chip Cookies | 10 Dec 2024 to 10 Dec 2025 |

| The White Cottage Restaurant & Lounge | Yangon | *10 % discount for All KBZ Credit Cards | 01 Jan 2025 to 31 Dec 2025 |

| HOURGLASS RESTAURANT & LOUNGE | Yangon | - Enjoy a 10% discount on the bill - Bottle charges will be waived completely | 01 Jan 2025 to 01 Jan 2026 |

| MONSOON RESTAURANT & BAR YANGON | Yangon | *10 % discount for All KBZ Credit Cards (Food Only) | 16 Jan 2025 to 15 Jan 2026 |

| Pai Cafe & Lounge | Yangon | - Exclusive 10% discount on bill - Minimum spending 15,000 MMK | 16 Feb 2025 to 15 Feb 2026 |

| Yangon Bakehouse Cafe | Yangon | Exclusive 5% discount on Bill | 16 Feb 2025 to 15 Feb 2026 |

| ZERO | Mandalay | 5 % discount on bill | 03 Jan 2025 to 03 Jan 2026 |

| Domi Cafe | Mandalay | 5% Discount Above 30,000 MMK | 15 Jan 2025 to 15 Jan 2026 |

| Japanese Paradise | Yangon | 10 % discount on Bill for All KBZ Credit Cards | 16 Mar 2025 to 15 Mar 2026 |

| HOK HOK Thai Mookata | Yangon | - Exclusive 10 % Discount on All Meat Set - Exclusive 10 % Discount on All Menu | 16 Mar 2025 to 15 Mar 2026 |

| Classic Japanese Cuisine | Yangon | 10 % discount on Bill for All KBZ Credit Cards | 16 Mar 2025 to 15 Mar 2026 |

| Garrison Bar | Mandalay | 5% Discount On Bill( Minimum Spending 150,000 MMK ) | 13 February to 12 February 2026 |

| The Little Mushroom | Mandalay | 5% Discount On Bill | 13 February to 12 February 2026 |

| D Lounge | Yangon | Exclusive 10% for all ala Carte Menu and Drinks | 16 March 2025 to 15 March 2026 |

| Funmily Bar and Restaurant | Yangon | 5% Discount on Bill (Minimum Spending 100,000 MMK) 15% Discount (Birthday Month) | 16 March to 15 March 2026 |

| Coffee Tree | Yangon | - 10 % discount on Bill for All KBZ Credit Cards | 16 March to 15 March 2026 |

| ရွှေရောင်လမ်းကော်ပြန့်စိမ်း | Yangon | - Exclusive 5 % Discount on Bill - Minimum Spending 10,000 MMK for All outlets | 01 May 2025 to 30 April 2026 |

| Coffee Culture | Mandalay | 15% Discount on bill | 03 March 2025 to 02 March 2026 |

| KSK Bakery Mandalay | Mandalay | Cookie Gifts (Minimum Spending 10,000) | 03 March 2025 to 02 March 2026 |

| Luxury European Cafe | Mandalay | 5% Discount On Bill | 04 March 2025 to 03 March 2023 |

| The Legacy Bar & Grill | Yangon | Exclusive 10 % discount on Bill for All KBZ Credit Cards | 16th May 2025 to 15th May 2026 |

| Oni By Kitchen Project | Yangon | Exclusive 10 % discount on Bill (Minimun spending 30,000 MMK) | 16th May 2025 to 15th May 2026 |

| PARAMI PIZZA | Yangon | 10 % off Total Bill For Parami & Golden Valley Branches | 16th May 2025 to 15th May 2026 |

| PARAMI EXPRESS | Yangon | 10 % off Total Bill For Parami & Golden Valley Branches | 16th May 2025 to 15th May 2026 |

| Rangoonian Burritos | Yangon | - Get 5 % Discount on bill if purchase above 20,000 MMK - Get 7 % Discount on bill if purchase above 100,000 MMK | 16th June 2025 To 15 June 2026 |

| Heaven Pizza | Yangon | Exclusive 20 % Discount on bill For All KBZ Credit Card. | 16th June 2025 To 15 June 2026 |

| The Heritage Flavour Restaurant & Lounge | Yangon | Exclusive 10 % discount on Bill for All KBZ Credit Cards | 16th June 2025 To 15 June 2026 |

| K2 Ice-Cream & Cold Drink | Yangon | Enjoy get a cup of Signature Fruit Ice Cream by purchasing 30,000 MMK and above. | 16th June 2025 To 15 June 2026 |

| Shwe Eain Tea House | Yangon | Exclusive 15% discount on bill minimun spending (10,000 MMK ) | 29th May 2025 to 28 May 2026 |

The KBZ MPU Credit Card is the most sophisticated and simple to use anywhere in the country that is connected to MPU. Since MPU Credit Card allows customers to effortlessly make transaction, it is very practical for online/offline payment, shopping and dining at the restaurants.

We currently offer KBZ MPU Credit Card (Classic, Gold and Platinum).

– Myanmar Merchant Acceptance

– Local Cash Advance, POS and Online Purchase

– No Interest Period 15 to 45 days

– Exclusive Privileges from KBZ Bank & MPU Benefits

The default currency for KBZ MPU Credit Card is Myanmar Kyats (MMK).

You can use your credit card for up to 3 years from the year of your application. The expiry date is located on the front of your KBZ MPU Credit Card.

You should renew your credit card a month before the expiration date by visiting any KBZ branch or contacting our call center.

The KBZ MPU Credit Card is accepted at all MPU-branded ATMs and can be used at local partner stores.

There are several wellness, travel, and lifestyle perks to using the KBZ MPU Credit Card. For further information, please visit https://myanmarpaymentunion.com/my/.

You must be a Myanmar Citizen or have PR status, over the age 21 years and have a verifiable source of income.

Classic – minimum income of 200,000 MMK

Gold – minimum income of 1,000,000 MMK

Platinum – minimum income of 2,000,000 MMK

Depending on the card the following are applicable:

MPU

Classic

Gold

Platinum

Joining Fee – Principle

Free

Free

Free

Joining Fee – Supplementary

Free

Free

Free

A credit card annual fee is a price that you will pay every year to remain a cardholder and enjoy the card’s rewards and benefits. The first year annual fees for KBZ MPU Credit Card is free of charge.

MPU

Classic

Gold

Platinum

Annual Fee – Principle

20,000

40,000

80,000

Annual Fee – Supplementary

10,000

20,000

40,000

Visit your nearest KBZ branch and fill out an application and don’t forget to bring the following documents with you:

Personal Information

NRC (Front and Back)

Household Registration (Census)

Ward Recommendation Letter

2 x Passport Photo

Guarantor (2 persons)

NRC (Front and Back)

Household Registration (Census)

Ward Recommendation Letter

2 x Passport Photo

Salaried

Recent Pay Slip

3 months Bank Statement

Employer Confirmation Letter

Copy of Tax Book

Self-Employed (Any Two)

6 months Bank Statement

Business License

Previous Year Tax Receipt

Yes, you are allowed up to 4 KBZ MPU supplementary cards. Application is only allowed for immediate family members over the age of 18 years.

Usually it takes around 14 working days for KBZ MPU Credit Card application to get approved.

KBZ MPU Credit Card application could get rejected for the following reasons:

– Incomplete Application Form

– Incomplete Supporting Documentation

– Income cannot be verified

– Ineligible Credit Standing

Visit the nearest KBZ Branch and request for a credit limit increase. This process may take up to a week to be approved.

Once you visit the KBZ Branch to collect the KBZ MPU Credit Card, KBZ Bank staff will direct you to fill in the necessary form to activate it. Once your card has been activated, you will need to change the temporary PIN at any KBZ ATM and after this process is completed, your KBZ MPU Credit Card is ready to be used. Please take note it may take a few hours to activate your KBZ MPU Credit Card, however, you can inquire about the activation status by contacting the call center.

This is a 6-digit sequence of numbers that you can choose for yourself and It’s important to remember it since you will be using it at ATMs and for Online or POS payments. If you have forgotten your PIN or you’re PIN has been blocked, you must visit your nearest KBZ Branch for a new one. Remember to bring your KBZ MPU Credit Card and NRC for validation purposes and 3,000 MMK will be charged for the reissue.

Currently you can pay off your credit card in the following ways:

– Auto debit from customer current Individual or Joint Account (Personal) a/c

– OTC at branch

– Mobile Banking (QuickPay)

– KBZPay (QuickPay)

If you register for the Auto Debit facility the credit card outstanding amount will be automatically debited from your KBZ Bank account on your payment due date every month. The payment will be credited into your credit card immediately.

You can make payment with two options

– Full Payment (Total Due Amount)

– Minimum Payment (10,000 MMK or 10% of Total Due Amount)

You can check your current balance at KBZ ATM or contacting the Call Center

If you do not receive your monthly electronic statements via email, you can visit a branch or contact the call center to resolve the problem. There may be an error with your email address, or you may need to update it.

The grace (interest free) period is between 15-45 days depending on day the transaction is made and is only applicable if full payment is made on the outstanding bill.

Interest free grace period is only applicable for purchase transactions and cash withdrawals are not included. The statement date will differ according to the credit card type:

MPU (Classic, Gold ,Platinum – 15th of each month)

Payment due date is on +15 days from the billing date.

Interest is calculated when only partial payment is made on the outstanding from the previous billing cycle. Interest will be calculated from the day the outstanding amount is due until all outstanding amounts are fully settled. Interest is calculated on a daily basis (Outstanding from the previous cycle x Annual interest rate)/365 x No. of days. There will be no interest applicable if full payment is made on the total outstanding amount on the statement, however, if a customer opts to make a partial payment, there will be no interest free period and interest will be charged. We currently charge 20% interest for all KBZ credit cards and Interest is calculated daily.

Whenever you exceed your credit limit, a monthly fee will be charged on the amount that exceeds the credit limit.

If you are planning to go overseas, you can request for a temporary increase for your credit card limit for the duration of the travel, need to give the document which is define by Bank. There will be charges depend on the card type for this facility.

You can withdraw cash up to 50% of your credit limit and for that you will be charged an ATM withdrawal fee on the withdrawn amount.

If you do not make payment (at least the minimum) by the due date, you will be charged late fees on top of the interest. If you neglect to make any payment beyond a specified period your card may be blocked, and the bank may initiate the necessary recovery actions including but not limited to legal actions. If you credit card bill is overdue for more than 30 days, your card will be automatically blocked, and you will be required to make a minimum payment before it can be unblocked and used again. 60 days, your card will be automatically blocked, and you will be required to make full payment before it can be unblocked and used again.

You will need to contact our call center or visit the nearest KBZ Branch and we will block the card immediately. You will then have to apply for a new card which will be reissued within 1 month. You can also block the card by yourself through the KBZ Mobile Banking Application under the Card Activity >> Card Services Menus.

You will need to visit the nearest branch and request to have your card replaced and will be charged 10,000 MMK as card replacement fee.

If the ATM is at located at the branch, a staff member will be able to return the card to you immediately if it is during working hours. For any other scenarios, contact the call center for assistance.

You can visit the nearest KBZ branch to cancel your credit card however, all outstanding amounts including fees and charges must be settled. If the primary credit card is closed, then all supplementary cards will be closed subsequently.

If you want to update any personal information, you will need to visit the nearest branch and fill out a change request form. For any other credit card related queries contact our KBZ 24×7 Customer Service Hotline – MPT Customers: +959951018555 Non-MPTCustomers:8555 @visit the nearest branch for more information.

Recommended Cards

UnionPay Credit Card

UnionPay International (UPI) is a leading payment card brand. The UnionPay card is increasingly becoming one of the most important credit cards in Asia with a merchant acceptance network extending to over 178 countries.

Visa Credit Card

KBZ VISA Credit Card gives customers instant access to money for POS or online purchases as well as cash advances at any ATM displaying the VISA logo. The current VISA acceptance network extends to over 200 countries.